50+ how much mortgage interest is tax deductible 2021

Homeowners who bought houses before. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly.

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Web For new mortgages issued after Dec.

. Married filing jointly or qualifying widow. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. The government actually lowered the limit in 2018.

Web But if your primary residence is 750000 and your secondary home is 250000 you would only get a tax break on 750000 and none of your paid interest. Web To enter mortgage interest in the TaxAct program go to our Form 1098 - Entering in Program FAQ. Web For 2021 tax returns the government has raised the standard deduction to.

Or 375000 if married filing separately. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web If the home was acquired after December 15 2017 the home acquisition debt limit is 750000.

15 2017 taxpayers can deduct interest on a total of 750000 of debt for a first and second home. Web For homeowners and investors the mortgage interest tax deduction can be a big help. Web The old rules allowed you to deduct interest on an added 100000 of the loan or 50000 each for married couples filing separate returns.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Get A Free Information Kit. There is an overall.

Discover Helpful Information And Resources On Taxes From AARP. For Homeowners Age 61. State and local real property taxes are.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Ad Compare the Best Reverse Mortgage Lenders. Web If your taxable income in 2021 exceeds 68507 69398 in 2022 its important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021.

Feb 10 2021 May 06. Web For the 2019 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct the interest paid on up to 750000 in mortgage. Before then it was set at 1 million.

Web The maximum limit on mortgage interest deductions is 750000. Web IRS Publication 936. Web This is known as our adjusted gross or taxable income.

Single or married filing separately 12550. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years. You paid 4800 in.

Now to the point -- the primary tax advantage of homeownership is the mortgage interest deduction. Web Web How much mortgage interest can I deduct in 2021. Learn about the rules limits and how to claim it.

Single taxpayers and married taxpayers who file separate returns. Per IRS Publication 936 Home Mortgage Interest Deduction page 2. The terms of the loan are the same as for other 20-year loans offered in your area.

For Homeowners Age 61. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. 12950 for tax year 2022. Web Standard deduction rates are as follows.

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction A 2022 Guide Credible

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Bankrate

We Break Down The Tax Brackets In Canada For 2021 And Provinces Too Based On Annual Income Moneysense

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

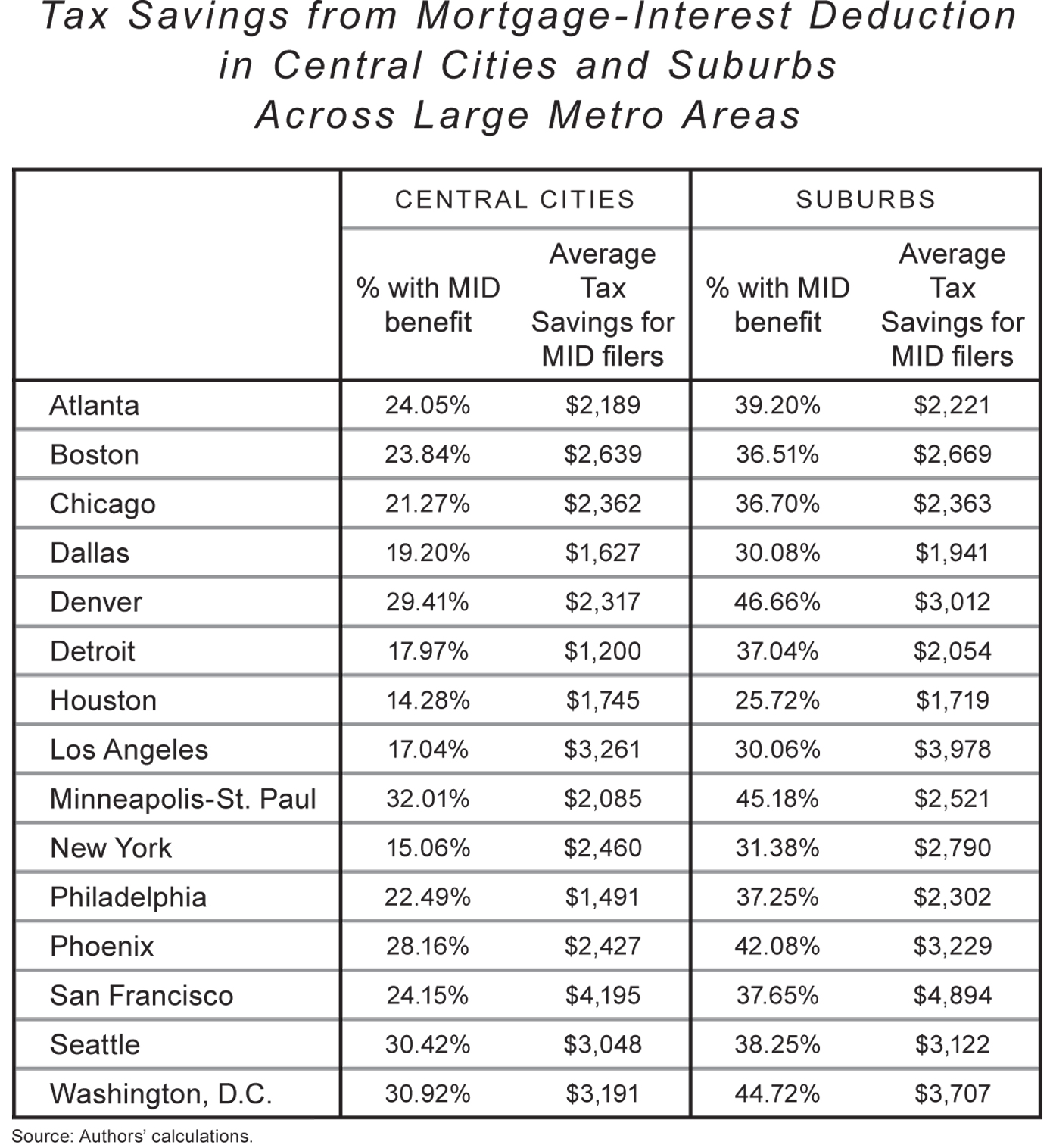

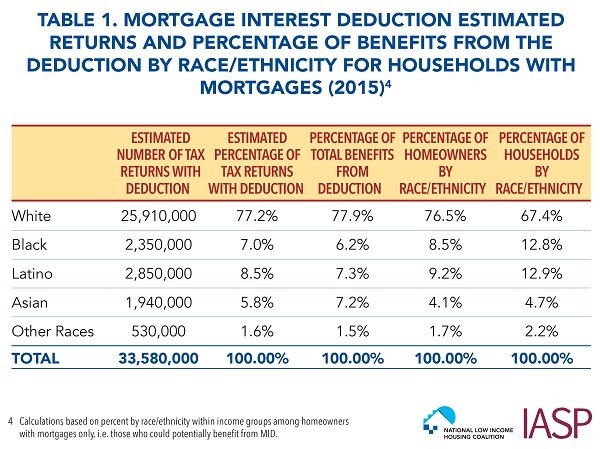

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Tax Deduction Calculator Freeandclear

Financial Planning Archives Good Life Wealth Management

A Guide To Buy To Let Mortgage Interest Tax Relief Sevencapital

Tax Deductions For Real Estate Agents

1040 Calculator Estimates Your Federal Taxes

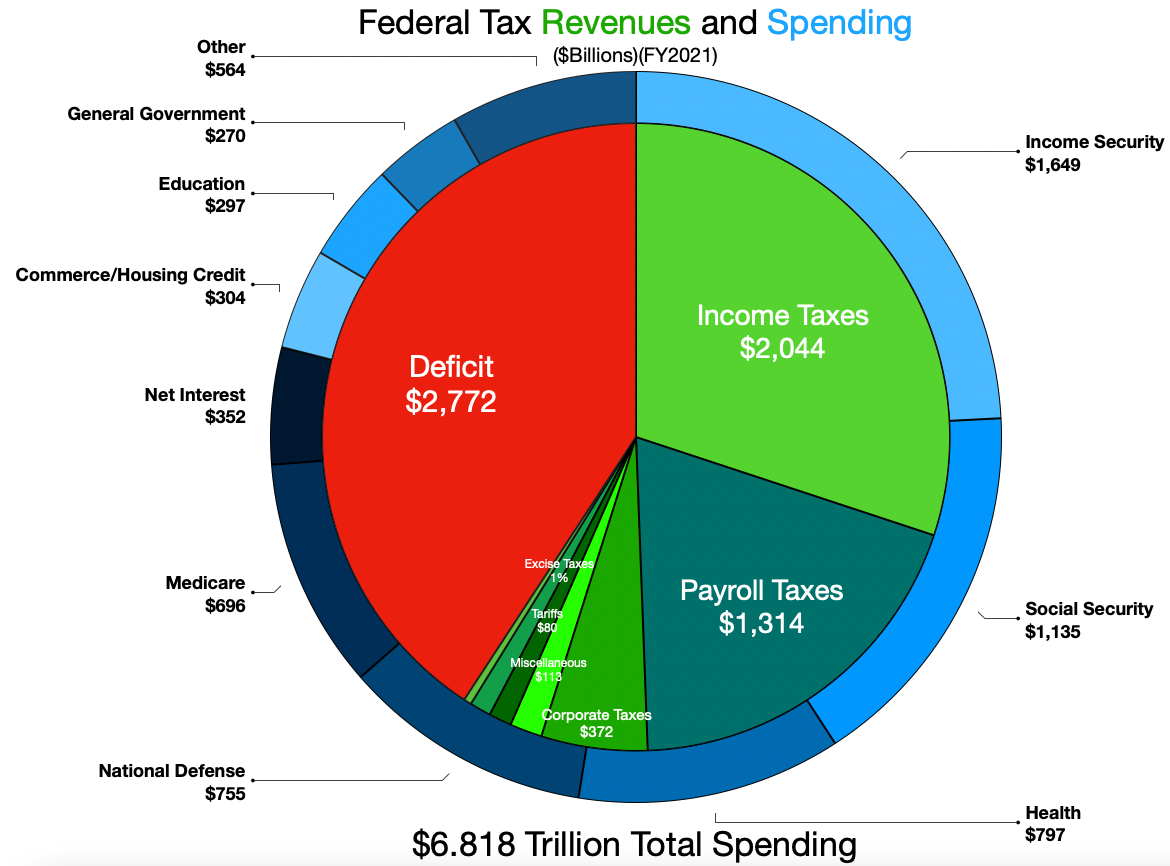

Deficit Reduction In The United States Wikipedia

Income Tax Issues For Older Adults Mtp 02 22 Pdf